JOSH BUCHANAN

June 10, 2024

Last Wednesday, the Bank of Canada cut their policy (key) interest rate from 5% to 4.75%. This was the first rate cut in over 4 years and was considered a likely announcement by the central bank.

This rate cut doesn’t necessarily change fixed mortgage rates, as the fixed rates are based on other factors. The real impact is felt on variable interest rates. However, a 0.25% interest rate decrease only reduces monthly mortgage payments by about $15 per month per $100,000 of mortgage principal outstanding. This isn’t a game changer by any means.

What is significant about this rate cut is that it impacts consumer confidence. From March of 2022 to July of 2023, the interest rate increases hurt consumer confidence and created fear and uncertainty in the market. After several months without increases, I think consumer confidence started to bounce back. With this recent interest rate cut, not only is it relief that the increases have stopped, but now they are either going to continue lower or, at least stay fixed for the foreseeable future.

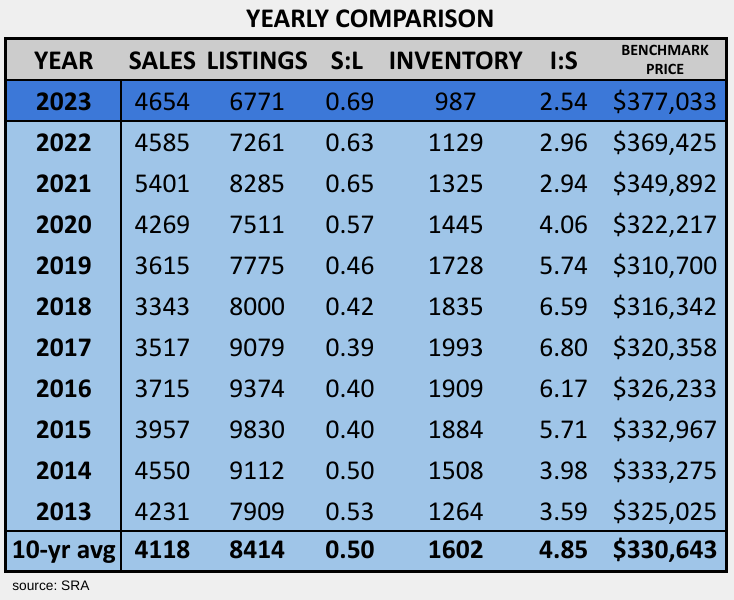

With Saskatoon’s market seeing the most competitive conditions in 17 years, a rate cut wasn’t needed to help stimulate the market. In fact, it will likely make things even more competitive here.

I’ve had a few people ask me what could cause the local market to change and be less competitive?

Generally, the housing market is slow to change or adjust. With the biggest issue right now being a lack of housing available and very strong demand, what needs to happen to change the market conditions is for 2,000 additional residential units to come available overnight. Obviously, this isn’t going to happen.

From a demand perspective, something major would have to happen to reduce demand. This could be something like a major change in immigration policy or some kind of mass exodus of people leaving Saskatoon. It could be a major increase in interest rates, or something more extreme like some kind of banking or financial crisis or another pandemic with lock down measures. These are hard to predict, however, I don’t foresee anything like that, at least not in the coming months.

So, in the short term, there doesn’t appear to be anything major that could change these market conditions barring some kind of unexpected shock to the system. This is why I am pretty comfortable in predicting that home prices will be on the rise this summer.

In the longer term, there is one variable that could change market conditions. That variable is based on what happens with mortgage rates when people go to renew in 2025 and 2026. Because there were so many homes purchased in 2020 and 2021, and a 5-year fixed mortgage term was the most common option at that time, it means a large percentage of people in Saskatoon and around Canada will be having their mortgage terms renewed starting in mid 2025.

The year 2021 was the busiest on record and although 2020 appears slow, it wasn’t. It’s just that sales were a bit slow to start the year and then the chaos of the pandemic impacted the market for the spring months which later resulted in a very busy market for the remainder of the year.

The long-term concern is how many people are going for mortgage renewal, likely in 2026. If they are going to be renewing at, say, 4.99% compared to the 1.99% rate they may have had from 2020 and 2021, this will create a significant increase in their mortgage payments.

If interest rates don’t fall significantly by that time, this could certainly change market conditions in Saskatoon. Many property owners may find it too difficult to make their mortgage payments at the increased rate and be forced to sell. This could create more listings and send the market in a different direction. However, it’s also possible that people in larger centers like Vancouver and Toronto will experience much larger impacts upon mortgage renewal and it could drive some of them to more affordable centers like Saskatoon.

It’s hard to say what will happen but it is one of the obvious variables that could eventually impact the housing market and one worth keeping an eye on.

—

You can support the blog by subscribing, sharing, commenting, sending an email or donation to jcb8485@gmail.com.